Integrated Delivery Networks: Market Landscape and Strategic Imperatives

Highlights of the report:

Download a PDF of these Highlights

Integrated Delivery Networks (IDNs) are working to respond to a number of market challenges impacting their businesses in 2025. HIRC's report, Integrated Delivery Networks: Market Landscape and Strategic Imperatives, provides a market overview of IDNs/systems, including recent market activity, the top trends driving IDN strategy, the status of IDN risk-bearing activities, and more. The following questions are addressed:

- What is the latest news and market activity in the IDN/health system segment?

- Which key market trends are driving IDN decision-making and overall strategy?

- What are IDN decision-makers' most urgent strategic imperatives to address as they adjust to a complex and dynamic market landscape?

- What is the status of IDN/systems' risk-bearing activities, such as health system-owned health plans, direct-to-employer contracts, insurer joint ventures, and participation in government and commercial value-based payment model programs?

- How are IDNs enhancing access to care across the continuum?

- What is the scope of IDNs' pharmacy services? What is the status of IDN/health system-owned specialty pharmacies?

Key Finding: In addition to pursuing business growth and improving the patient experience, IDNs' 2025 strategies include a keen focus on technological advancement/AI integration and improving their margins & financial positions.

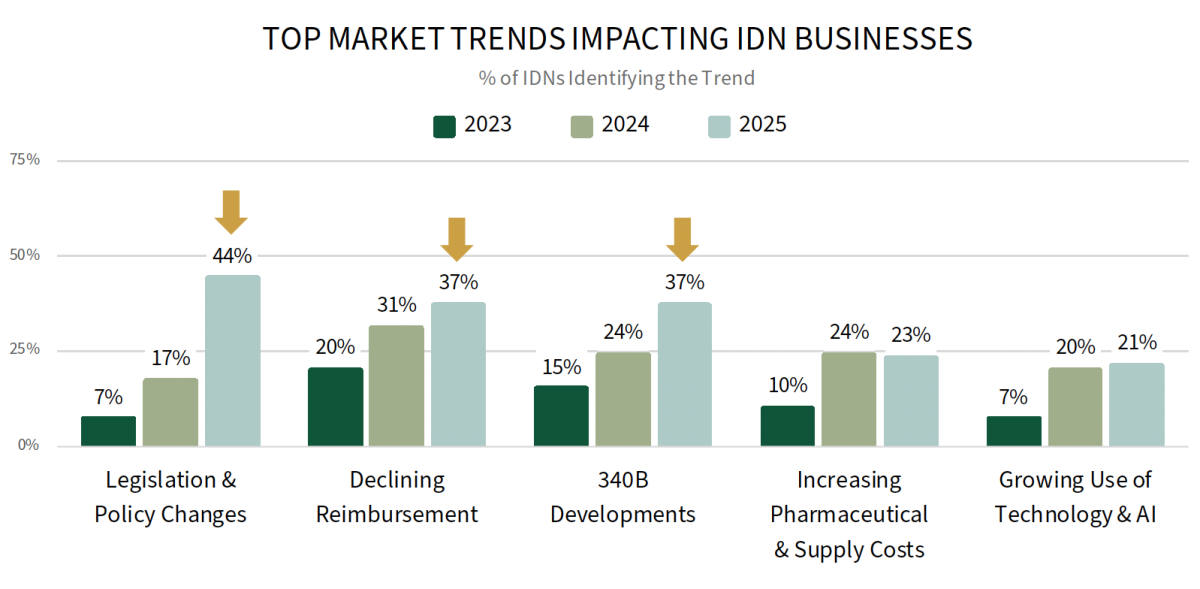

IDNs are Increasingly Concerned with Legislation & Policy, Declining Reimbursement, and the Future of 340B. Most top of mind for IDN business leaders in 2025 is a general uncertainly around legislation/policy and the new Administration. The continued implementation of the IRA, possible changes to the ACA, and an overall possible reduction in government-subsidized health care are among areas of concern. IDNs also increasingly mention declining reimbursement and future 340B program changes as top trends driving their business and growth strategies in the coming years.

The full report provides the complete listing of most impactful market trends and IDNs' strategic imperatives for 2025.

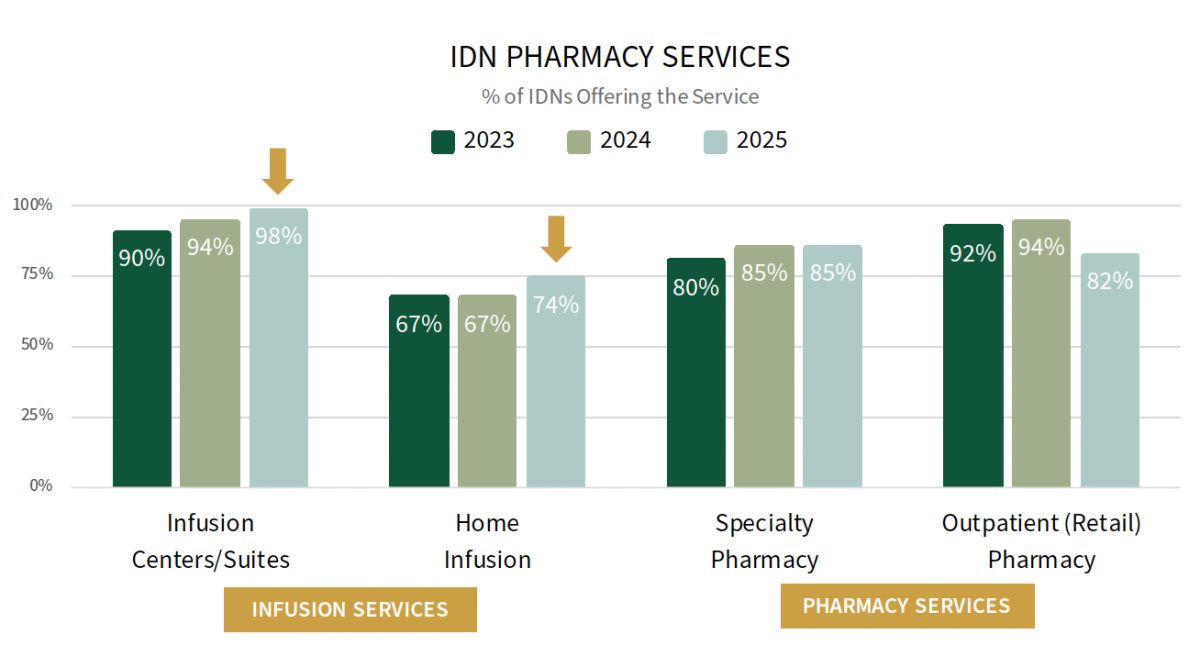

IDN Pharmacy Services Demonstrate Focus on Outpatient Infusion Strategies. IDNs continue to respond to reimbursement and payer site of care challenges by ensuring patients have access to care in outpatient settings, and non-hospital-based infusion strategies have proven critical to keeping patients inside health systems. In 2025, nearly all IDNs offer infusion centers/suites (98%) and 74% offer home infusion. In addition, most IDNs have specialty pharmacy capabilities after rapid growth over the last decade.

IDNs are also increasing access to outpatient care through investment in home health, ambulatory surgery, and immediate care. The full report provides an overview of IDN capabilities across the continuum of care.

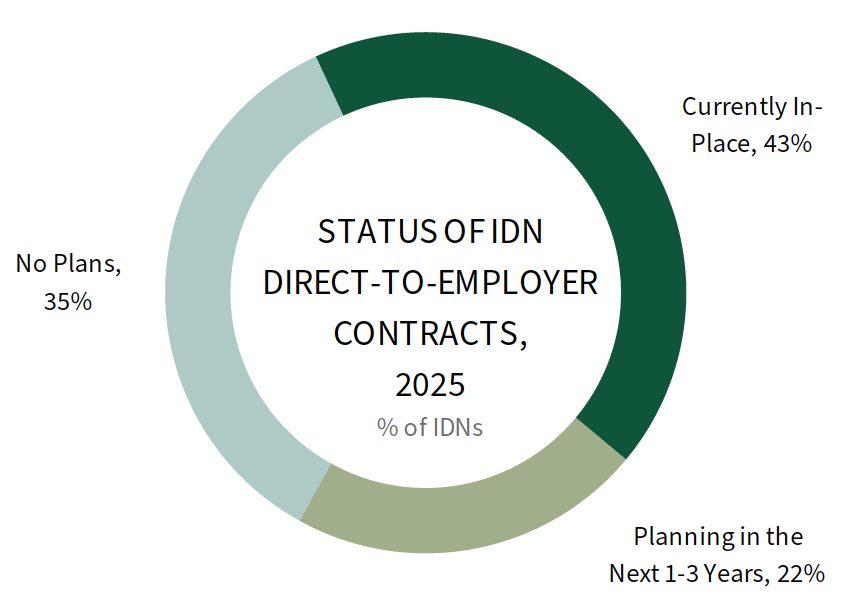

IDNs Show Increasing Enthusiasm for Employer Contracting. IDNs assume risk for the costs and quality of care associated with the populations they serve in many ways, such as via health system-led health plans, health insurer JV offerings, contracting directly with employers, and value-based reimbursement initiatives with government and commercial payers. During in-depth interviews, IDN leaders shared an enthusiasm towards contracting directly with employers for health services. While under half of IDNs are doing so currently in 2025 (43%), another 22% are planning to engage in direct-to-employer contracting in the coming years. Under these arrangements, IDNs are most often contracted to provide medical services and wellness programs to employees.

The full report examines the status of several additional IDN risk-bearing activities.

Research Methodology and Report Availability. In December and January, HIRC surveyed 52 IDN senior leaders and pharmacy and medical directors. In-depth secondary research, online surveys, and follow-up telephone interviews were used to gather information. The full report, Integrated Delivery Networks: Market Landscape and Strategic Imperatives is part of the Organized Providers Service, and is now available to subscribers at www.hirc.com.

Download a PDF of these Highlights

Download Full Report (Subscribers only) >